tax deferred exchange definition

The 1031 Exchange allows you to sell one or more appreciated assets generally rental or investment real estate but could be non-real-estate. Define Tax Deferred Exchange.

What Is A 1031 Exchange Properties Paradise Blog

What Is A 1031 Tax Deferred Exchange.

. Also known as Like-Kind. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition. 2020 Instructions for Form 8824 Like-Kind.

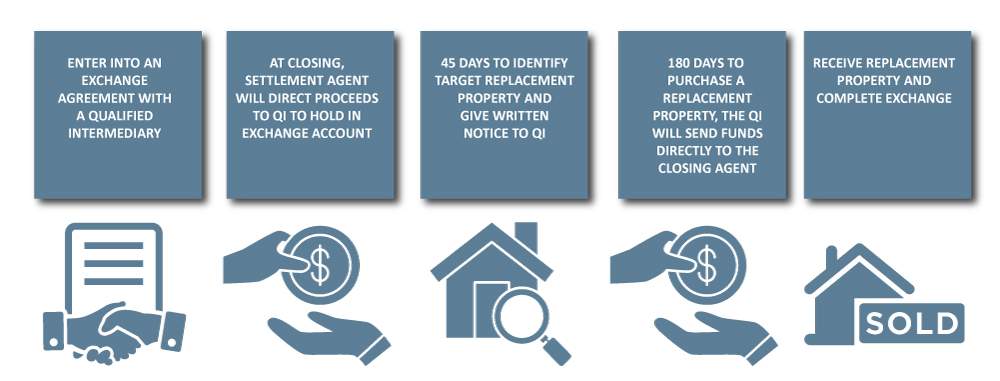

Specifically the tax code referring to 1031 Exchanges in IRC Section 11031 reads No gain or loss shall be recognized on the exchange. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. More What Is Section 1031 of the Tax Code.

Going by the IRC description of section 721 c a US. Taxpayer will realize gain when that taxpayer contributes section 721 c property to a section 721 c partnership. Commonwealth of Massachusetts.

Adjective not taxed until sometime in the future. 5 Simple Ways to Invest in Real Estate. Is a reverse tax-deferred like-kind exchange pursuant to section 1031 of the Internal Revenue Code of 1986 as amended and Revenue Procedure 2000.

A tax-deferred exchange also referred to as a like-kind exchange a 1031 exchange a threeparty exchange or a Starker exchange may provide a way for you to take that 26000. Those taxes could run as high as 15. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes.

Over the long term consistent and proper use of this. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction. A tax-qualified defined contribution account offered by employers to help grow employees retirement savings.

A 1031 exchange is similar to a traditional IRA or 401k retirement plan. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third 13 of your gain or profit toward the payment of. 1031 Tax Deferred Exchanges Accessed April 10 2021.

Enter the 1031 Tax Deferred Exchange. Generally have to pay tax on the gain at the time of sale. Real Estate Definition.

Has the meaning set forth in Article 15. The theory behind Section 1031 is that when a property owner has reinvested the sale. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes.

A tax-deferred exchange is also called a 1031 tax-deferred exchange and 1031 is a section of the Internal Revenue Service that identifies investment property. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

The exchange aspect of it is if you exchange one piece of property of equal or greater value than the value of the property that you have you dont have to recognize any gain. Although it turns out that a Starker Exchange is just a delayed 1031 exchange by any other name it helps. When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are.

An example of a tax-deferred vehicle is a 401k plan. Ultimately the 1031 exchange is a completely legal tax-deferred strategy that any taxpayer in the United States can use. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar.

By completing an exchange. Define Reverse Tax-Deferred Exchange.

Investopedia 100 Top Financial Advisors Of 2019 Early Retirement Career Change Retirement Budget

The Basics On 1031 Simultaneous Tax Deferred Exchanges 1031 Exchange Place

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

6 Steps To Understanding 1031 Exchange Rules Stessa

1031 Exchange How You Can Avoid Or Offset Capital Gains

What Is A 1031 Exchange Asset Preservation Inc

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

Capital Employed Accounting And Finance Financial Management Shopify Business

What Is A 1031 Exchange Asset Preservation Inc

Image Result For Finance Management Accounting And Finance Project Finance Finance

Pin On Printable Real Estate Forms 2014

1031 Exchange When Selling A Business

Tax Deferral How Do Tax Deferred Products Work

What Is The Benefit Of Tax Deferred Growth Great American Insurance

1031 Exchange Explained What Is A 1031 Exchange

The 1031 Exchange For Real Estate Investors Key Points To Know

1031 Exchange Like Kind Exchange Definition What Is A 1031 Exchange Real Estate Investing Investing Capital Gains Tax